Strategic Financial & Statutory Planning for Established Businesses

ENSCONCE Business Process Consulting · Oct 22, 2025 · 5 min read

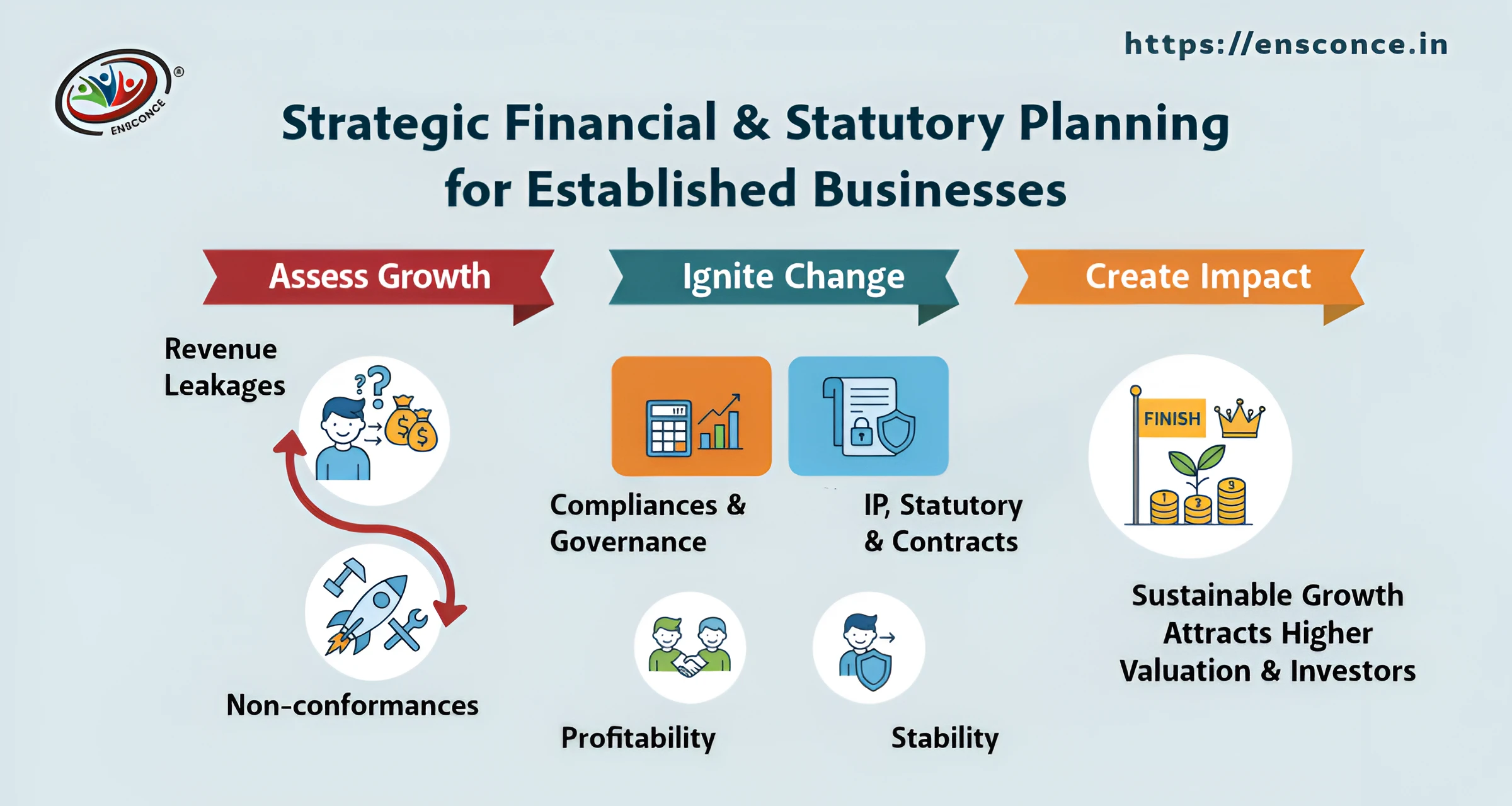

As businesses grow and mature, the tension shifts from rapid expansion to more disciplined growth, excellence in compliance, and long-term sustainable growth. To CXOs and business leaders, solid financial and statutory bases are more than just hygiene issues — they are strategic levers that help protect profits, assure regulatory readiness and increase trust among stakeholders and investors.

This article shares actions you can take to improve your financial management and compliance framework to safeguard your company.

Strengthening Financial Planning to Drive Predictable Growth

For established companies the early-stage flexibility is replaced with the requirement for predictability and structured decision-making. Financial planning evolves from simple forecasting to advanced scenarios as well as capital allocation plans. With improved financial visibility, leadership can make informed decisions about expansion, diversification and operational efficiency.

Key Focus Areas:

- The rolling forecasts align with strategic business objectives

- Multi-scenario cash flow modeling

- Strategically allocated funds to business units

- Proactive buffers for risk mitigation

Upgrading Accounting Infrastructure for Better Control & Insights

Established companies usually have accounting procedures in place, however many do not have the integration, transparency, and real-time information required for quicker decision-making.

Best Practices:

- Review and modernize the chart of account to incorporate current income streams as well as business sectors.

- Transition from transactional accounting to insight-driven reports using modern cloud tools.

- Automate reconciliations and inter-company transactions to eliminate manual mistakes.

- Standardize monthly closes and perform variance analysis versus budgets.

- Create clear approval workflows and guidelines for vendor financial hygiene.

Results: better control, fewer surprises and improved readiness for audits.

Budgeting & Forecasting as Strategic Shields

For established businesses budgeting isn't just about forecasting the future; it's about making plans for a variety of futures. A structured budgeting and forecasting system allows CXOs to quickly adjust to market changes without disrupting operations.

Scenario-Based Planning:

- Base Case: steady-state and planned expansion.

- Positive Case: aggressive expansion or high conversion rates.

- Downside Case: economic slowdowns, delayed collections or market disruptions.

Maintain rolling 12-month forecasts and focus on cash position, working capital cycle and investment capacity.

Reinforcing Statutory Compliance to Protect Reputation & Capital

As companies grow, regulatory complexity increases across industries, locations and functions. A proactive statutory plan helps you avoid fines, safeguards reputation and increases investor confidence.

Core Compliance Focus:

- Timely filings for payroll, GST, PF and industry-specific regulations

- Centralized compliance calendars with owner mapping

- Documentation and proactive statutory audits

- Management dashboard alerts for compliance milestones

Navigating Evolving Regulatory Landscapes

Contrary to new businesses, established firms often operate across multiple states or countries, creating jurisdictional and sectoral layers. Create a simple regulation map with key regulations, review frequencies and an escalation structure to stay accountable.

Avoiding Penalties Through Predictive Compliance

Late filings have ripple effects beyond fines — they can delay funding, create contract risk and harm reputation.

Implementation Tips:

- Automate alerts and filing workflows

- Reserve compliance funds (2–4%) for unexpected liabilities

- Conduct monthly compliance audits to identify red flags early

Aligning the Financial Strategy to the Growth of Your Business

Finance should guide strategic decisions rather than merely support operations. Connect CAC, LTV and margin data to deployment choices and review forecasts with product, marketing and operations to ensure collaboration.

Strategic Finance Integration:

- Connect CAC, LTV, and margin data to expansion/diversification decisions

- Align workforce investments to pipeline visibility

- Review forecasts cross-functionally with product, marketing and operations

Continuous Cash Flow & Expense Monitoring

Large firms have multiple spending centers — without real-time oversight, leakages multiply. Practical measures include monitoring top 10 expense heads weekly, setting automated threshold alerts, and reviewing unit economics monthly.

Strategic Planning for Investments & Future Rounds

Even established businesses need structured capital planning — debt restructuring or private equity expansion financing require clean financials, aligned forecasts, stronger controls and a clear investor narrative.

Preparation Framework:

- Keep clean and professional financial statements

- Align forecasts with capital deployment strategy

- Strengthen internal controls and governance documents

- Develop a strong investor narrative backed by transparency

From Reactive to Proactive: The Before & After Shift

Prior to: financial and statutory processes are piecemeal with firefighting and coordination delays.

After: a structured financial intelligence system provides real-time visibility into compliance and capital plans, preventing crises and increasing enterprise value.

Conclusion

For established businesses, robust budgeting and statutory planning is not only about compliance but about staying competitive. With well-organized processes and integrated strategy, businesses can scale with confidence and secure margins.

👉 Join forces with Ensconce to modernize your finance infrastructure, improve compliance security, and build governance for investors. Get a free consultation today.